For those who wish to outsource the management of their investments, we offer portfolio management services. This involves investment of the portfolio per our agreed-upon Investment Policy Statement, regular monitoring of the portfolio for rebalancing opportunities, quarterly performance reports and an Annual Review meeting where we review the portfolio and the status of your financial plan. Portfolio management is only available to clients who have completed a Comprehensive Financial Plan. Portfolio management services are charged based on the fee schedule below.

Fee Schedule

| Annual Advisory Fee | Portfolio Value | Fee as Percent of Portfolio Value |

|---|---|---|

| FIRST | $2,000,000 | 1.00 Percent |

| NEXT | $3,000,000 | .80 Percent |

| NEXT | $5,000,000 | .70 Percent |

| AMOUNT OVER | $10,000,000 | .50 Percent |

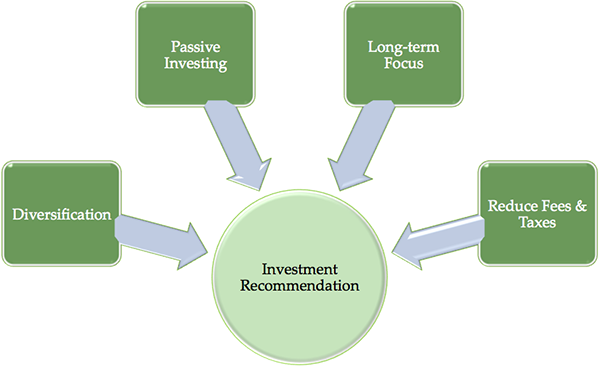

The following philosophy underlies our investment recommendations:

The markets are efficient most of the time.

It is therefore difficult for active managers to outperform their indices consistently over the long-term. As a result, we tend to recommend passive index funds and ETFs for most asset classes.

The only “free lunch” in the investment world is diversification.

Though it works better at some times than others. This means that an investor can improve returns simply by building a portfolio of investments that have low correlation to each other (i.e., one zigs while the other zags). To take advantage of this phenomenon, we recommend fully diversified portfolios to our clients, including asset classes such as fixed income, US stocks, foreign stocks, real estate and commodities.

Market timing does not work.

As a result, we focus on long-term strategic allocations to asset classes and individual investments and do not frequently change our recommendations.

High expenses reduce returns.

We focus on minimizing expenses by using low-cost funds and trading infrequently. After-tax returns can be further improved with tax-loss harvesting and other strategies, such as the location of tax-inefficient investments in retirement accounts.