Every summer when I spend a week or two in Tahoe for vacation with my family, I fantasize about owning a cabin there. This summer, I decided to analyze what it would actually take to make this dream a reality.

While some people can afford to own a second home without thinking twice, for many of us, taking on a second set of home-related expenses is a huge financial commitment. I wanted to know how much rental income would be required to make a vacation home cash-flow neutral, thus minimizing the financial burden. Before I get into the specifics, it’s important to start with the big picture.

- Is owning a vacation home really the goal? Before deciding to buy a vacation home, it’s important to make sure that is really the best way to achieve your family’s dream. Ask yourself a few questions, such as “what is it about owning a vacation home that appeals to us? Do we enjoy spending most of our vacation time in the same place? Is it about spending time in that place together or about the memories in a specific home that we treasure? Is there a less expensive way to achieve our vision? You may find it far less expensive and less of a hassle to just rent the same home every year to build shared memories with your family.

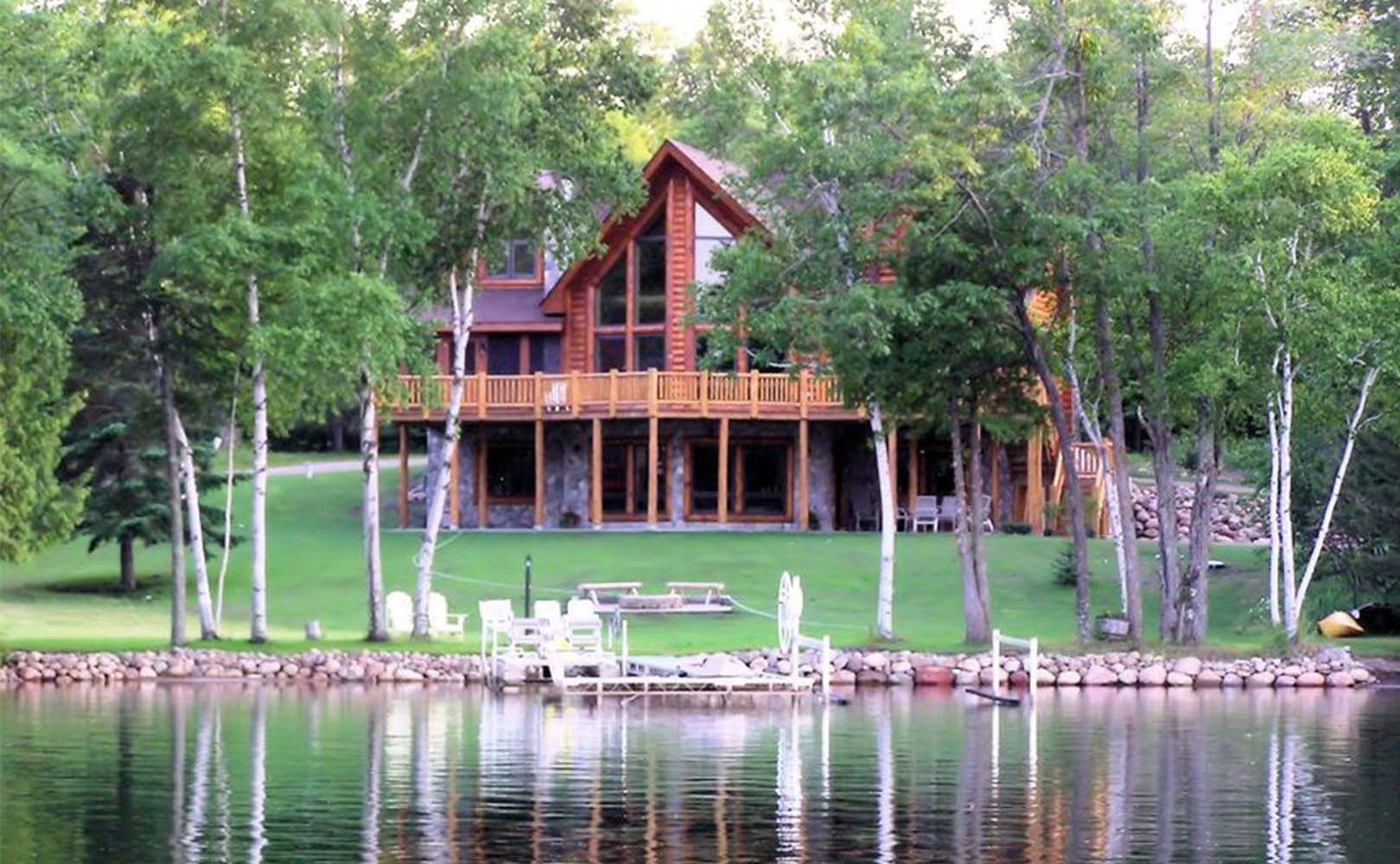

- Where should we buy? If you decide that owning a vacation home is the best way to achieve your vision, then you need to figure out the best location and attributes. Do you mainly go up in the winter to ski or in the summer for water sports, hiking or biking? Taking into consideration your main activities, what is the best location for a vacation home? You might also take into consideration distance from your home as drive times can vary widely, especially if you are driving up and back at popular times like Friday evening and Sunday afternoon. Prices can also vary greatly by location. I analyzed buying a place in Serene Lakes as that is where my family stays in the summer.

- What attributes increase marketability? If renting the home out is critical at least in the early years, talk to a rental agent to determine what characteristics increase the marketability as a rental. For example, my research indicates having at least three bedrooms, ideally one those a bunk room, is important as many rentals are shared by two families. Also, proximity to a lake for summer or ski resorts in winter is also important. Finally, being pet-friendly, having wifi and a hot tub are other popular features for the rental market.

- How much can we afford? Once you’ve determined your ideal location and your desired features, it’s important to figure out how much of a house you can afford. Vacation homes typically require a 20% down payment or more. How much of a mortgage can you qualify for? Talking to a mortgage broker before shopping for a home can save you time by letting you know how much you can realistically afford to pay. While the mortgage is the biggest expense, don’t forget all the other expenses of home ownership, such as property taxes, insurance and maintenance. Due to the adverse climate, home maintenance in Tahoe can be higher than in the Bay Area. Snow plowing, repaving driveways, refinishing decks and exterior walls are significant expenses for mountain vacation homes. A good starting point is to assume 1% of home value per year for maintenance expenses. It looks like we could get a 3-bedroom home near the lake for $500,000 at Serene, which would require a $100,000 down payment. All-in costs would be about $40,000/year.

- Will the rental market cover your costs? Once you have a good estimate of total expenses of owning a vacation home, talk to a rental agent or other home owners in the area to see if the rental market is robust enough to cover your costs. How much do vacation homes rent for? Don’t forget to reduce the rent by 25-30% if you’d be likely to use a rental agency to handle property management. How many days would you need to rent your home out to cover your costs and is this likely in your market? Would renting it out for this many days leave any time for your family to use your dream home at desired times? If your family would want to use the home at popular times like Christmas, New Year’s, Ski Week and 4th of July, then assuming rental income will cover your expenses might be an aggressive assumption. Assuming rent of $350/night and after deducting a 30% management fee, we’d need to rent the home out about 80 days a year to make it cash-flow neutral. While this may not seem like many days, keep in mind that very little rental activity occurs in Spring and Fall, making for relatively short seasons in the Winter and Summer.

If you come through this exercise and feel confident that buying a vacation home is the best way to achieve your vision and the financial burden is manageable then you are well on your way to achieving your dream. However, if it still seems a bit of a stretch, consider finding another family you trust to buy the home with. While this scenario has its own complexities and should be carefully thought through, it can cut in half the financial commitment and make you less reliant on the rental market to make your dream a reality. Also keep in mind that the financial burden will ease as your income and rental income grows, but the fixed mortgage expense stays the same. In summary, owning a vacation home can help satisfy a dream for many people, but is a significant financial commitment and should not be undertaken without careful analysis and planning.