Fall is in the air. The kids have headed back to school. It is an exciting and busy time of year for most of us, but it’s particularly hectic for high school seniors getting ready to apply to colleges. As we all know, the cost of higher education is an expensive endeavor. For some families, financial aid is a critical component that enables students to fulfill their college dreams.

The FAFSA, or Free Application for Federal Student Aid, is the form that goes live every October 1st. It needs to be completed for a student to be considered for any financial aid from the government to help pay for college. Each year over 13 million families who file the FAFSA receive more than $120 billion in grants, work-study, and low-interest loans from the U.S. Department of Education. Many states and colleges also use the FAFSA to help determine who will get financial aid and how much they will receive.

A few important things to remember for the FAFSA:

- You must fill it out annually to be considered for aid each academic year.

- Both undergraduates and graduate students can apply.

- Remember to create your Federal Student Aid (FSA) account early, as it can take up to three days to become active. One parent & the student need to have an FSA ID. To apply for an FSA ID, you visit. To apply for an FSA ID, you visit ed.gov.

- You may qualify for financial aid even if a high-income family, so every family should complete the FASFA form. If you don’t file, you won’t be eligible for most aid.

- It is essential to submit the FAFSA early as financial aid is often given out on a first-come, first-served basis. However, waiting a few days past October 1st is a good idea as the website often crashes in the first few days.

- You do not have to complete the FAFSA in one sitting. But before you start the form, you’ll want to have the following important documents on hand, including your tax returns (prior, prior year), current bank statements, and personal identifiers like social security numbers and driver’s license on hand.

- Deadlines vary by school. So check college websites or contact financial aid offices to confirm dates for FAFSA submission. Deadlines also vary by state.

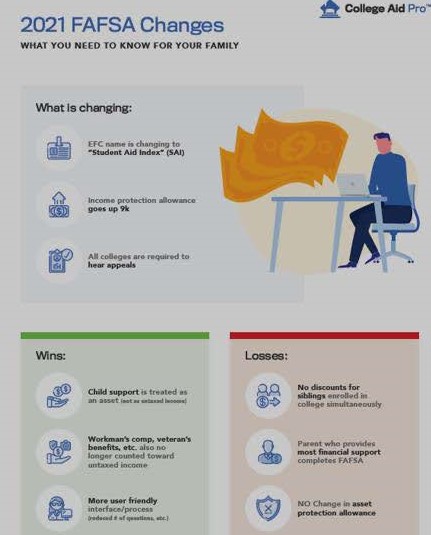

There are changes coming to the FAFSA form, driven by the passing of the Consolidated Appropriations Act of 2021, but which won’t go into effect until July 1, 2023, for the 2023-24 school year. Some beneficial changes include extended eligibility for Pell Grants to a broader range of students and fewer questions on the form itself. Two negative changes are the elimination of sibling discounts for multiple kids in college and for divorced families, the parent who provides most of the financial support will be required to complete the application, not the custodial parent. For a comprehensive explanation of future changes, check out this Forbes article by Mark Kantrowitz.

Anyone considering attending college can and should fill out the FAFSA. If your child doesn’t qualify for need-based financial aid and hopes to be the recipient of merit-based assistance, submitting a FAFSA is in your family’s best interest, regardless of how much income you make.

It doesn’t matter if your child will attend a private university or state college. Most of us will agree that the cost of college is unreasonably high. Filling out the FAFSA will likely reduce tuition costs and help make higher education aspirations a more affordable reality for many families.

The official Department of Education, FAFSA website is Fafsa.ed.gov