It seems like people are whispering about inflation everywhere you turn, and it’s for a good reason. Rising prices have the power to eat away at your purchasing power and erode the value of your assets.

With the topic of inflation dominating the headlines and given that it can be highly impactful on your financial life, we’d like to share a few data points, which hopefully provides some context to the current state of economic affairs.

- Current Inflation Readings Suffer from the Base Effect. As of September 30th, U.S. consumer prices were up by 5.4% from a year ago. Why is this important? The current inflation rate is being calculated by comparing today’s price level to that from September 2020. In September 2020, the U.S. economy was the middle of some of the darkest days of the Covid pandemic. Commerce was highly disrupted, most of the country was locked down, travel had nearly stopped, the government was pouring money into the economy, consumers were hoarding cash, and demand for goods and services was weak. Because the most recent inflation number is being measured relative to a weak point in the economy, and given the economy has since recovered, it’s natural to have an abnormally high inflation reading. This is known as base effect. If we step back and look at inflation in a broader context, inflation has actually been running at 2.6% over the last five years, which is below the long-term historical average of about 3% going back to 1926.

- A Little Inflation Is Healthy for the Economy. When we hear the word inflation, we collectively shudder and return to visions of the stagflation of the 1970’s. However, from an economic perspective, some inflation is considered healthy. Inflation is a sign of a growing economy and is much better than the opposite scenario, deflation, which has afflicted Japan for decades. Inflation makes it easier on debtors (government, corporate and individual), who repay their fixed principal loans with growing cash-flow. This encourages borrowing and lending, which increases spending on all levels. Also, inflation leads to higher wages, which in turn puts more money in consumers’ pockets. Finally, growing corporate profits lead to rising stock prices.

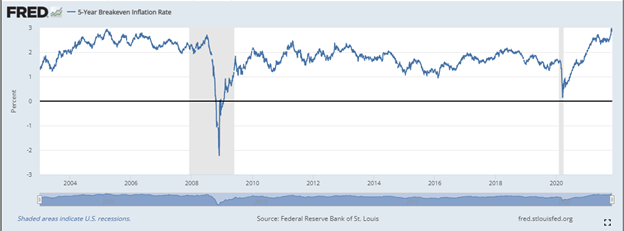

- The “Market” Thinks Inflation Will Be Lower in the Future. While financial experts continue to debate where inflation is heading, there is one collective group that votes every day with actual dollars on where they believe inflation is headed, and that’s “the market.” Using real world data representing billions of dollars of transactions published by the St. Louis Federal Reserve, is a measure known as the 5-Year Breakeven Inflation Rate, which compares the 5-year nominal Treasury yields with yields on 5-year Treasury Inflation Protection Securities (TIPS) to produce a number reflecting the market’s expectation of future inflation rates. As of November 4th, 2021, the “the market” expects the U.S. inflation rate to average 2.9% over the next five years, well below the most recent inflation reading, and close to the historical average. Rather than trusting a single person’s opinion, we would prefer to trust the “markets” reading of future inflation rates, and as of now, that view is that inflation will be lower in the future.

- Inflation is a financial topic charged with emotion. That’s because it affects each person’s wallet in a very personal way. Inflation is real, and to say that there is zero risk of spiraling out of control would be false. However, given the facts about how inflation is reported, why a little inflation is a good thing, and how the market perceives future inflation rates, we believe the current elevated level of inflation remains more persistent than originally forecast, but still a temporary phenomenon. And one that is likely to subside as the economy finds its footing after a massively disruptive global pandemic event.