While much hand wringing and media attention has been focused on the negative aspects of the current bout of high inflation (much of it rightfully so), from a spirit of optimism, we’d like to take a few moments to focus on the positive aspects of higher inflation. Yes, from an economic and individual taxpayer perspective, there are a several benefits of increased inflation. Here are a few silver linings of higher inflation.

1. Higher social security payments. The cost-of-living adjustment (COLA) on retiree social security payments is tied to an inflation index (CPI-W). For 2023, social security payments will increase by 8.7%, the highest rate since 1981.

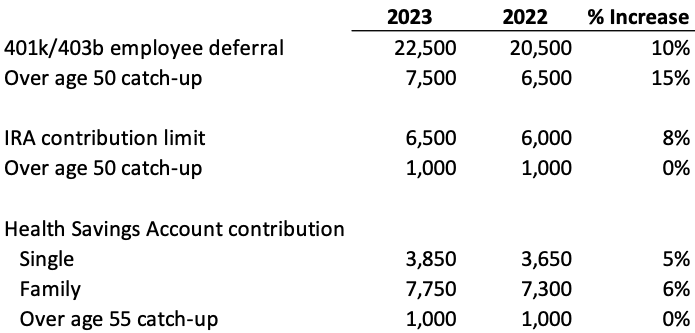

2. Higher retirement account contribution limits. The amount you can contribute to various retirement accounts has also increased substantially for 2023, allowing workers to set aside more money for retirement and potentially reduce their taxable income.

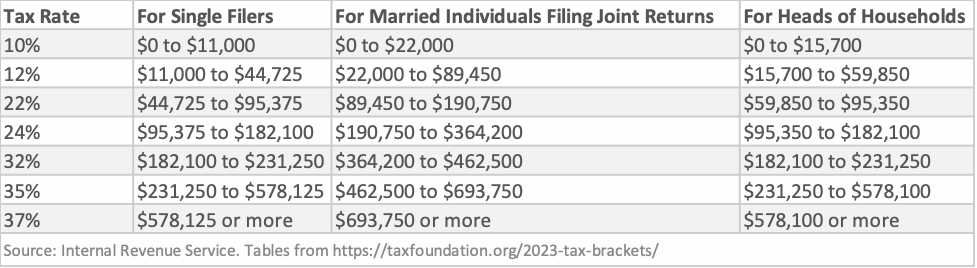

3. Higher tax brackets and standard deduction. The standard deduction increased 7% to $25,900 for joint filers and $13,850 for single filers. The tax brackets increased by 7% also allowing more income to be taxed at lower rates.

4. Higher deposit account interest rates. Interest rates are finally rising on savings accounts, CDs, and other deposit accounts and remain high on Series I bonds issued by the US Treasury. It is now possible to earn 3% or more in an online high-yield savings account. While still below the current inflation rate, it increased substantially in the past year. These rates should continue to rise if the Fed continues to increase the Fed Fund’s rate. While down from the 9.6% offered on I bonds purchased through 10/28/22, these bonds still offer attractive interest rates tied to current inflation rates.

5. Higher annual gift exclusion and estate limits. The annual gift exclusion has risen to $17,000 from $16,000. This is the amount a person can give to any other person without using up your lifetime gift and estate tax exclusion or paying gift tax. That lifetime estate and gift exemption also enjoyed a significant increase, to $12.92M in 2023, a 7% increase.

So, while there are certainly negative impacts from inflation, it’s not all bad news and there are several silver linings as well. Retirees will soon get a big raise, workers can contribute more to their retirement accounts and shelter more income from taxes, and savers can earn more interest on their hard-earned savings.