After an abnormally calm 2021, which saw stock markets reach all-time highs, the major stock indices are sharply lower in 2022. Volatility has returned to the market as concerns over interest-rate tightening, inflation, supply shocks, economic growth, and geopolitical events have dampened last year’s market exuberance. Recently, the S&P 500 benchmark was flirting with what Wall Street calls a bear market, which is defined as a 20% decline from a security’s (or index’s) all-time high. The most significant losses have come from richly valued technology stocks, with the bond market also experiencing its most significant decline in 40 years. With distressing news coming out of the investment markets, and the value of your savings going down, we’d like to offer a few points that hopefully provide some perspective on this year’s events.

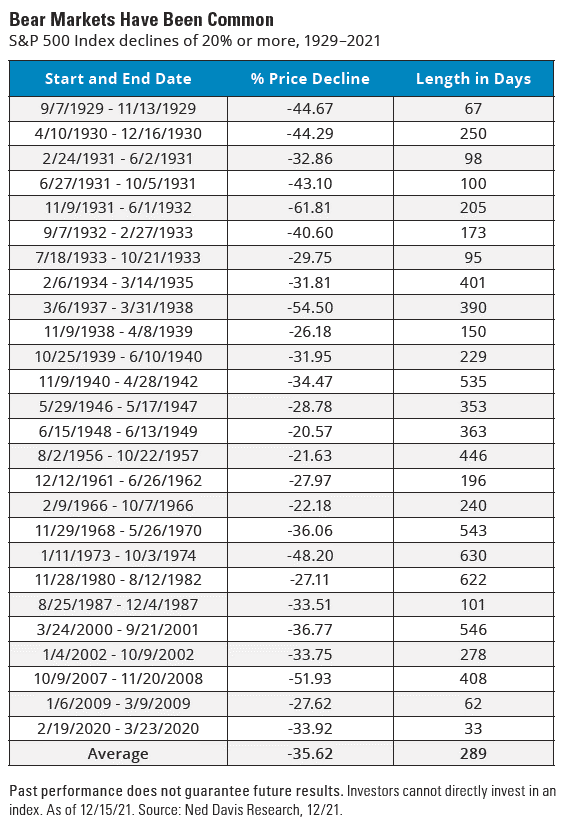

Bear markets are more common than we like to think. Since 1928, there have been 26 bear markets, fifteen of which were accompanied by a recession. The average stock market decline was 36%, and the average length was 9.6 months. Bear markets are part of the investment experience and cannot be avoided if you’re a long-term investor and need or want to earn the higher returns offered by investing in the stock market. That being said, bear markets do not last forever, and every bear market has a bull market on the other side. In fact, approximately 75% of the time, stocks go up, and 25% of the time, they go down. This year, at least so far, is one of those periods of decline. Finally, remember stocks have more than doubled in the last two years, making a 20% or more decline even more plausible given how fast and far the markets have trended upwards.

Another topic that is making headlines is the prospect of a recession. One important thing to note is that recessions and bear markets aren’t the same, and history tells us that although recessions are sometimes correlated with bear markets, this is not always the case. Just because we’re experiencing a bear market doesn’t mean we’re about to experience an economic collapse. In fact, according to the latest Bloomberg monthly survey of economists, 37 major economists found the probability of a recession over the next 12 months is now 30%, the highest since 2020. It appears the odds of a recession are increasing. However, when, how, and the depth and effect of a potential recession are fundamentally unknowable. To prepare for a possible downturn, you should maintain a healthy emergency savings, reduce debt, and live within your means.

How should we handle the prospect of a bear market? First, we encourage you to stay calm and focus on the things you can control vs. the things you cannot. It’s easy to believe that a down market will continue to fall, so it’s enticing to think you can just cut your losses and buy back in later. However, empirical evidence suggests that trying to time the market in this way is very dangerous. History tells us that if you miss just a few days of the stock market’s biggest positive gains, you drastically reduce your overall returns over the long term. When this is the case, it’s better to stay invested and hold through market volatility. Next, it might be tempting to curtail adding new money to your investments, such as turning off your 401k contributions or not investing excess cash. With the market down, now is actually a good time to invest new cash at discounted prices. Very often, the best returns when investing come right after a bear market. There is an old saying in investing, be fearful when others are greedy, and greedy when others are fearful.

One other simple strategy to help you cope with a falling stock market is to stop checking your account daily or even weekly. The reason for this is to thwart a powerful human bias called “loss aversion.” Loss aversion is a natural tendency to prioritize avoid losses over earning gains. Behavioral scientists have found that the pain of a loss is more strongly felt than the pleasure of an equivalent gain. Because of this bias, research has shown that investors are more likely to take risks when they check their stock performance every day, whether changing which stocks they invest in, their investment strategy, or withdrawing funds altogether.

No one can truly tame a bear market. However, knowing what a bear market is, how long it lasts, and its relationship to recessions helps place the recent market downturn into context. Knowing that bear markets are part of the investor experience allows us to focus on what we can control vs. what we can’t and may even help us see a bear market as an opportunity. Although this year has been both distressing and a little frightening, take heart in knowing what we see in the investment markets is considered normal and that this too shall pass.