In honor of the 51st Earth Day on April 22nd, we thought we’d provide an update on one of our favorite topics, Environmental, Social & Governance (ESG) investing, also often referred to as sustainable investing. Here are several themes:

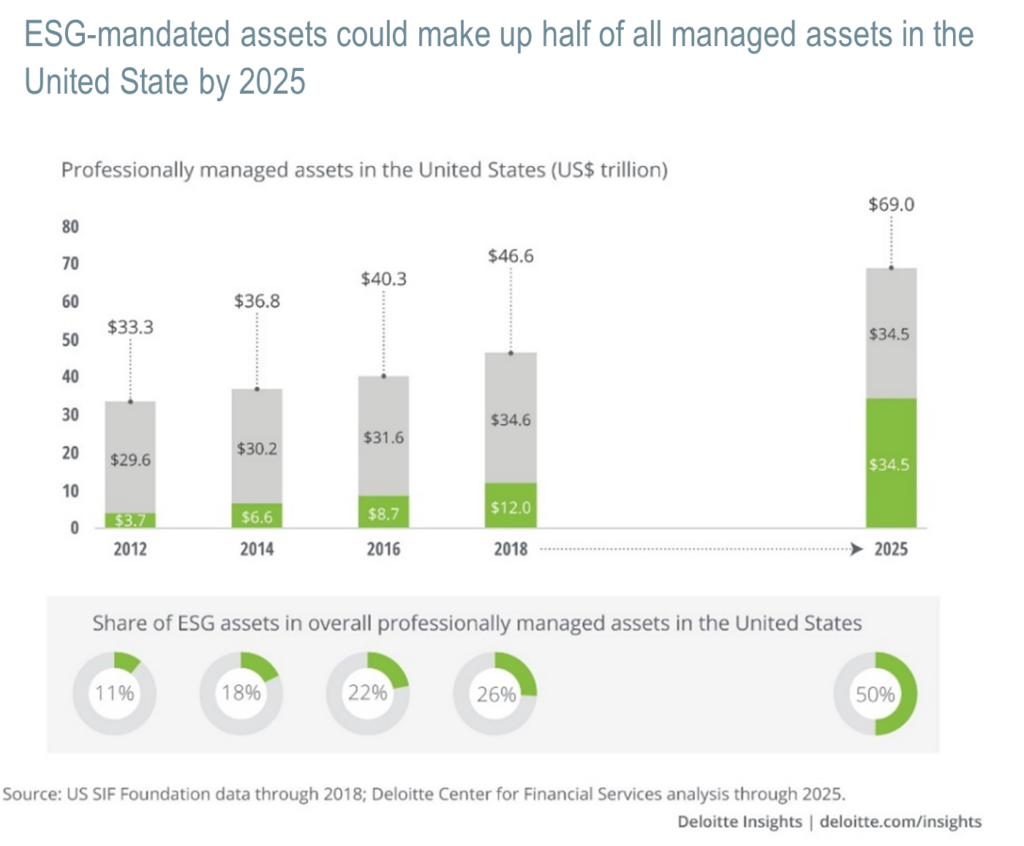

- Continued growth in assets. Sustainable investment funds accounted for approximately 25% of overall US fund flows and attracted a record $51B in net flows in 2020, more than twice the previous record set in 20191. It is estimated that ESG strategies will make up 50% of all managed assets in the US by 2025 (see chart below).

- New fund choices. The number of sustainable investment vehicles increased by 30% in 2020, ending the year with a high-water mark of 392 options.

- Solid performance. While longer-term studies indicate market-rate returns for sustainable/ESG funds, with slightly less risk than conventional peers, 2020 was a particularly strong year for sustainable fund performance. 75% of stock funds were in the top half of their peer group and 43% were in the top quartile.

Given the strong fund flows, increasing investment fund choices, and solid performance, it seems ESG/sustainable investing is here to stay. RGWM believes it is a better way to invest because it entails considering more data points when evaluating companies than just financial metrics. RGWM clients are increasingly invested in this way, with approximately 80% of our clients and 60% of assets in ESG/sustainable/impact investments. And in honor of Earth Day, we introduced a Fossil Fuel Free fund choice to clients this week.

Source: 1: Morningstar 2020 Sustainable Funds US Landscape Report.