After seeing markets close at or near an all-time high in late 2021, 2022 is off to a rough start. Interest rates are set to rise, inflation has been more persistent than initially forecast, Omicron put a damper on the holiday season, new geopolitical risks are looming, and Washington’s Covid stimulus measures appear to be drying up. With the introduction of these risks, volatility has significantly increased. January saw huge daily stock price swings, with many major indices closing at or near market correction territory. With fear seemingly driving the markets, now is an excellent time to remind ourselves of the nature of stock markets, the value of taking a long-term view on investing, and what investors should focus on when markets misbehave.

Volatility Is Normal. From a historical perspective, there is nothing abnormal about how stocks have moved up and down these past few weeks. What’s abnormal is that stocks rose almost 28% last year but fluctuated with about two-thirds their usual intensity. Recognizing that volatility is a normal part of investing helps put the recent market behavior into perspective. Since 1928, on average, the S&P 500 has experienced at least a 10% market decline once every 19 months and a bear market every four years. If markets were placid all the time, investors wouldn’t be compensated for taking on the additional risks of investing in stocks compared to simply placing their money in U.S. Treasury bonds.

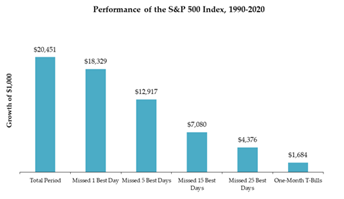

Timing the Market is a Dangerous Game. When volatility returns to the markets, it’s seductive to believe investors should sell out of stocks and buy back in when it dies down. Looking back at past market corrections and crashes, this strategy seems obvious. In reality, trying to time the market to avoid major downturns is not only nearly impossible, but it’s downright dangerous to long-term investors. The following statistic best exemplifies this: if an investor invested $1,000 from 1990 to 2020, their money would have grown to $20,451. If this same investor missed the single best day in the market, their money would be worth $18,329. If they missed the twenty-five best days, their money would be worth $4,376, not much better than simply investing in one-month T-Bills. Also, history tells us the best days tend to come early in stock market rallies when pessimism is high, and fear grips the market. Because nobody has a crystal ball and timing the market is a risky game, the logical thing to do as a long-term investor is to ride out volatility storms, stay disciplined, and avoid knee-jerk selling reactions.

Focus On the Things You Can Control. It’s been said that it’s better to focus on what we can control and let go of what we can’t. As an investor, we can’t control market behavior or market returns. Like spectators at a high-impact sporting event, we are at the market’s will. However, we can control the diversification levels of our portfolios, our overall asset allocation, the process of rebalancing, and when we choose to invest. These four focus areas allow intelligent investors to buffer the effects of market volatility and even take advantage of when stocks are mispriced due to short-term negative sentiment.

Although 2022 is off to a difficult start, remember that volatility is a normal part of stock investing and is one of the primary reasons why stock investors receive higher returns than simply putting their money in government bonds. Also, cage the urge to sell when the market misbehaves. History tells us this is a risky strategy leading to lower long-term returns. Finally, focus on what you can control and not what you can’t, like maintaining a highly diversified portfolio, periodically assessing one’s risk tolerance and asset allocation, rebalancing to take advantage of short-term trading opportunities, and putting extra cash to work when the markets offer the opportunity.