After a relatively tranquil and upwardly moving 2021 in the stock market, 2022 is off to a rocky start, further exacerbated by Russia’s historic invasion of Ukraine, which started the worst land war in Europe since World War II.

While forecasts abound about what is likely to happen and how to benefit from said certainties within your investment portfolio, what is clear is that the future is inherently unknowable. Markets don’t like uncertainty, hence the wild swings in global stock markets over the past several weeks.

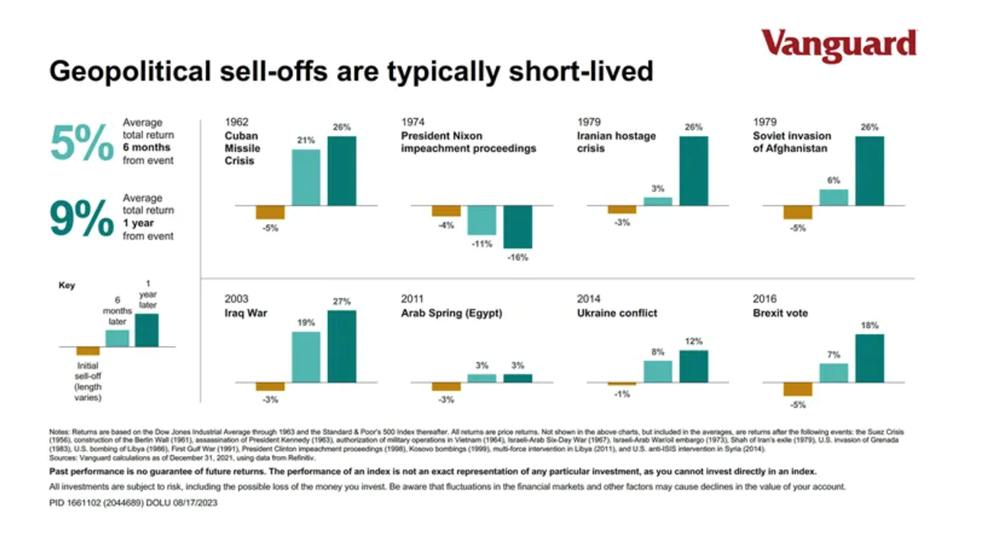

Let’s examine how the markets have reacted to past geopolitical events. Looking back at how geopolitical shocks affected the market helps place the seemingly dire nature of the Ukrainian situation into some context. While markets take a hit in the initial period after the crisis starts, on average, stocks are up 5% six months later and 9% a year later, as illustrated in the Vanguard chart below.

We know from behavioral finance that making investment decisions based on fear and anxiety rarely results in good long-term investment outcomes. In times of uncertainty, the best thing to do is focus on what you can control, such as staying on track to reach your goals, re-assessing your risk tolerance, and taking care of your personal and professional life, so you remain resilient and flexible. Our job as financial planners is to guide clients through these difficult times by helping them stay focused on the big picture, to monitor their portfolios for rebalancing and tax-loss harvesting opportunities and encourage clients to put cash to work when markets offer discounted prices. Although counter-intuitive, when faced with uncertainty, sometimes the best answer is often to do nothing and wait until the storm passes.