Many people are currently in open enrollment for employee benefits right now. An often-overlooked employee benefit that can really pay off in the long-term is the Health Savings Account (HSA). HSAs provide a tax-advantaged way to save for healthcare costs, now or in retirement.

Originally introduced in 2003, HSAs have gained in popularity and are now a common employee benefit. An HSA is a savings and investment account available to employees who also sign up for a high-deductible health plan (HDHP). Approximately 30% of insured workers use a HDHP, which have lower premiums, but higher deductibles and out-of-pocket maximums. To help cover some of the costs, many employers will contribute some money to an HSA and the employee can also make tax-deductible contributions. The limit in 2021 is $3,600 for single individuals and $7,200 for a family, with a $1,000 catch-up for each eligible participant over age 55.

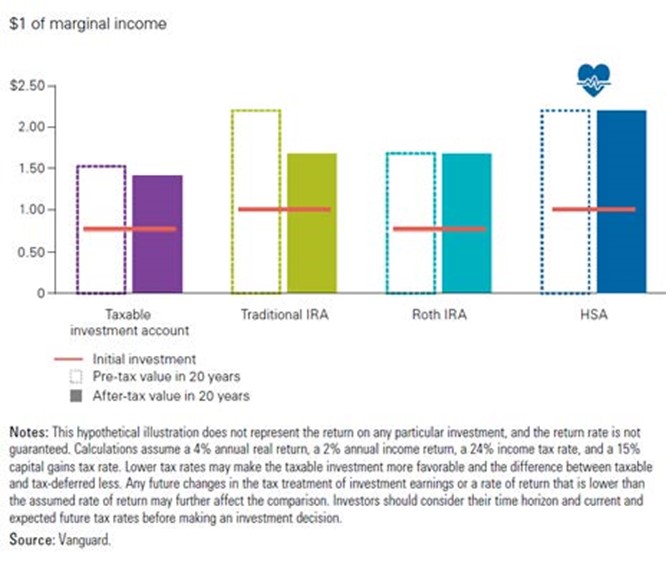

While the contributions are tax-deductible and growth is tax-deferred, what really makes the HSA attractive is that distributions are tax-free if used for eligible healthcare expenses. If an employee contributes the maximum allowed each year and doesn’t use it to pay for current medical expenses, but instead invests it for use in retirement, when medical costs are typically higher, this can really add up to significant amounts over time. This amounts to triple tax-deferral and is better than a Roth or Traditional IRA. The chart below shows the pre- and post-tax value of $1 invested in various account types over 20 years.

For those who can afford it and who don’t have expensive chronic health conditions that might make a lower deductible health plan more beneficial, the way to maximize the advantage of an HSA is to contribute the maximum allowed each year, invest the account balance in a diversified manner and let it grow for use on health care expenses in retirement. Use other money for current year out-of-pocket medical expenses prior to retirement. This will enable the HSA account to build up a substantial balance for medical expenses in retirement and no tax will ever be paid on this account, as long as it is used for approved medical expenses.